Research

Virtual Cards in Travel Payments: Four Trends for 2025

With the total number of virtual card transactions set

to grow to 175 billion, Modulr and Visa look at how

travel businesses can optimise their use.

Produced in partnership

Key insights from this report:

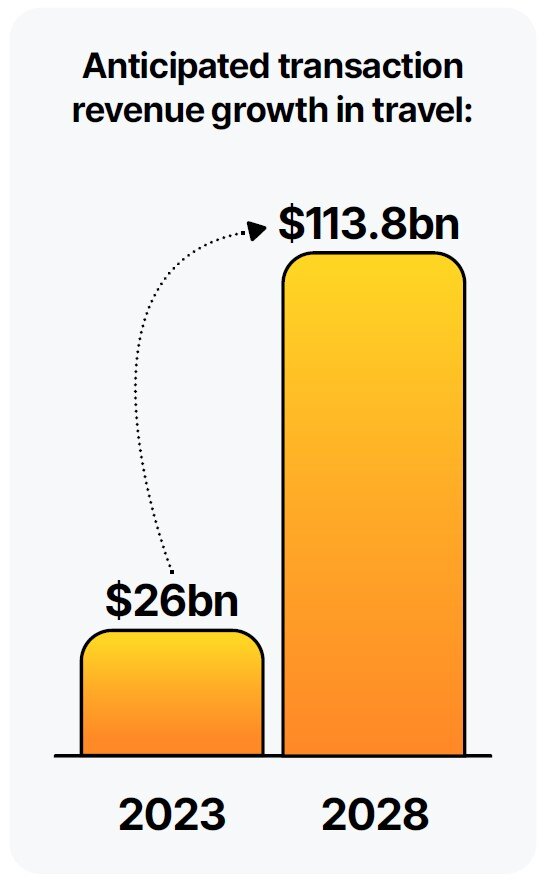

- The revenue generated by virtual card transactions in the travel sector is set to rise to $113.8 billion by 2028. B2B travel businesses need to focus on how to enhance this technology's capabilities to extract more value from it.

- Europe’s travel markets saw 2023 gross bookings increase by an average of 16.25% across the region: rising to €68 billion in Germany, €55 billion in France, €17.2 billion across Scandinavia and £47.3 billion in the UK.

- Independent bookings are rising in popularity, already making up over 80% of travel bookings in the US. To adapt, online travel agencies will need to invest in their customer interfaces and payments.

- Strengthening their defences against fraud is a priority for many businesses, with 90% saying they believe digital fraud will rise in 2024.

- 60% of companies surveyed said they haven't explored automation solutions for virtual cards, representing a substantial growth opportunity.

Get your copy to:

- See how you can use virtual cards to streamline payments, cut costs, automate reconciliation and mitigate liquidity risk.

- Identify ways that online travel agencies can stay competitive as direct and independent bookings grow in popularity by upgrading your payments to appear more personalised.

- Learn how virtual cards can help strengthen your defences against fraud in a market where security is a top priority for every stakeholder involved.

Download your copy now

Submit your email to get your copy of Virtual Cards in Travel Payments: Four Trends for 2025