Modulr launches Payment Initiation to give merchants a faster way to accept payments

-

Payment Initiation, powered by Modulr, enables businesses to accept payments directly from their customers’ banks

-

Benefits include real-time settlement, instant notifications and reduced risk of fraud

-

Available to existing and new customers and partners

London, Edinburgh and Dublin, 11th June, 2020

Modulr has announced the launch of its Payment Initiation solution, after registering with the Financial Conduct Authority as a Payment Initiation Service Provider (PISP). This will give Modulr’s customers a new, fast and cost-effective way of accepting payments.

The new solution will be welcomed by businesses that are underserved by the current ways of accepting payments. Although card payments deliver a smooth customer experience, they can incur significant fees for merchants that process large transactions. And traditional bank transfers are slow and outdated, requiring customers to leave the merchant’s page, often resulting in drop-off.

Modulr’s Payment Initiation allows merchants to accept payments directly from their customers’ banks. The process is as easy and streamlined as accepting card payments, but the solution operates on a fixed fee basis rather than charging a percentage per transaction. This could lead to significant savings for merchants.

Payments land directly in Modulr accounts and users can receive instant notifications via web-hook when funds have arrived. This speeds up reconciliation and allows merchants to process customer refunds at a push of a button. And since payment information is prepopulated, the customer experience is streamlined and there’s no risk of entering the wrong payment amount or bank account number.

Modulr’s Payment Initiation can also reduce the chance of fraud, as it requires customers to verify each transaction through their bank which commonly uses two-factor authentication.

The appeal to merchants is clear, but other sectors will benefit from Modulr’s Payment Initiation too. It will provide neobanks with a cost-effective and streamlined way of letting customers top up their accounts. And it will give many other sectors – from property services to lending – a faster and more reliable way of taking payments from customers or clients.

Modulr’s Payment Initiation is currently connected to major UK banks with European banks to follow.

Jakub Zmuda, Chief Product Officer at Modulr, says: “Payments are too important to get wrong – yet many businesses are struggling with hidden inefficiencies in their payments processes. Existing payment methods simply aren’t fulfilling the needs of merchants, especially those that are processing large volumes or high value transactions.

“Modulr’s Payment Initiation will be a game-changer for any business that accepts customer payments. It’s fast, easy and secure – delivering instant notifications and a more streamlined customer experience. It’s the next big step towards delivering the Instant Economy for our users and their customers.”

For more information, read our Payment Initiation guide.

Gallery

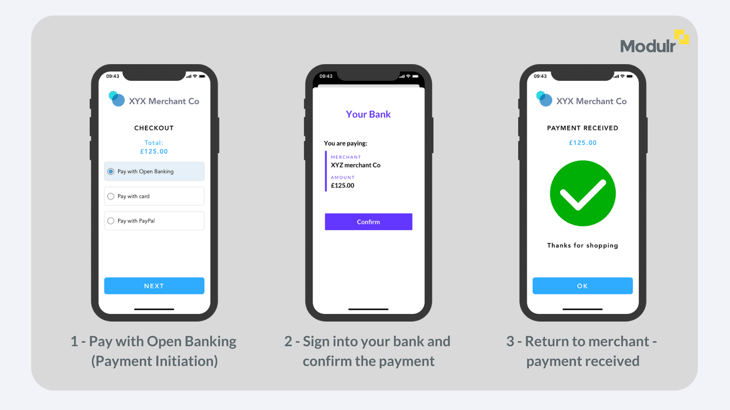

Example user journey of Payment Initiation, powered by Modulr

About Modulr

Modulr is the Payments as a Service API platform for digital businesses. It integrates into any product or system. Modulr’s new type of payment accounts are built for businesses that need a faster, easier and more reliable way to move money. Businesses can automate payment flows, embed payments into their platforms and build entirely new payment products and services themselves. All managed in real-time, 24/7 from one API.

Modulr’s API makes it easy for businesses to streamline existing services, launch new products and scale more efficiently. Modulr Finance Limited (FRN: 900699) is registered with the Financial Conduct Authority as an EMD Agent of Modulr FS Limited (FRN 900573). Modulr FS Limited is an Authorised Electronic Money Institution, regulated by the Financial Conduct Authority.